will the salt tax be repealed

The 10000 cap would in theory resume in 2024 and 2025. Congress the President the states and the IRS will all have roles in the last chapters.

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

No SALT no deal they said.

. This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031. Everything Keeps Coming Up Roses for the 200000 to 500000 Set. Expansion of SALT Cap Workaround SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of 7 percent of taxable income for tax.

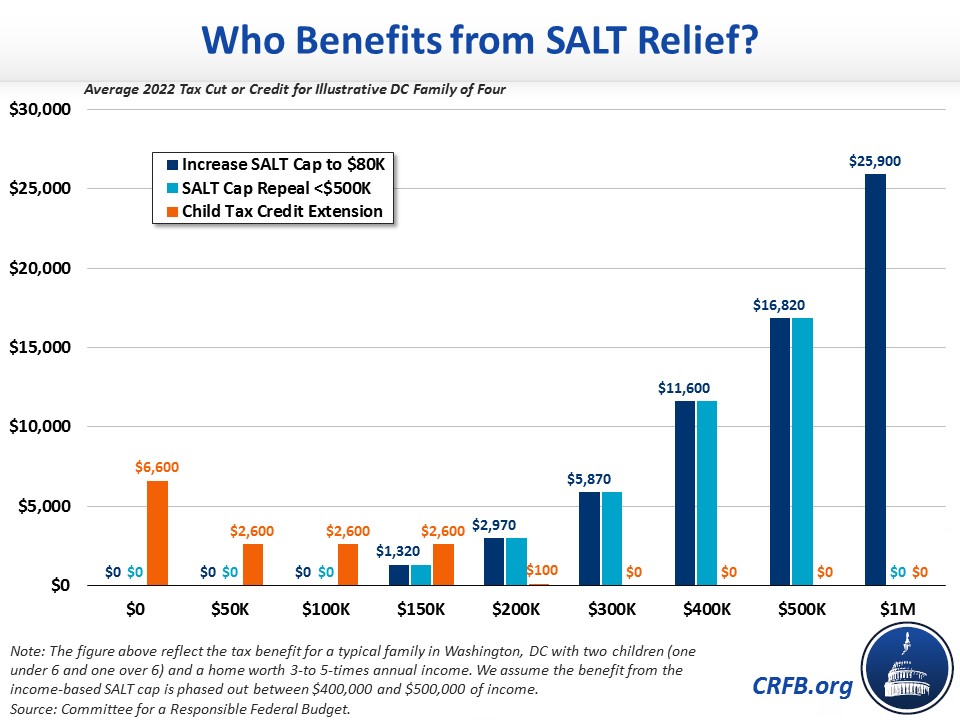

A new bill seeks to repeal the 10000 cap on state and local tax deductions. The HENRYs high earners not rich yet were treated well by. It is important to understand who benefits from the SALT deduction as it currently exists and who would benefit from the deduction if the SALT cap were repealed.

A two-year SALT cap repeal. A key Democratic lawmaker said a detailed final agreement to restore the federal deduction for state and local taxes could be reached this week with another advocate flagging a temporary repeal of the breaks limit as the likely proposal. All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent.

Over 50 percent of this reduction would accrue to taxpayers in just four. The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus. A group of Blue State Democrats has insisted on some SALT fix as their price for.

The SALT limit deduction brought in 774 billion during its first year according to the Joint Committee on Taxation and a full repeal for. In many cases high-income filers will have to pay higher taxes as a result. A Democratic proposal aims.

Finally the TCJA also put a new limit of a 10000 cap on SALT deductions reducing its value for many taxpayers. Under the 2017 Tax Cuts and Jobs Act TCJA the. On Tuesday Mr.

The bottom 80 percent would see minimal benefit. Most Democrats wanted to restore at least a portion of. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. The TCJA also repealed the Pease limitation for tax years 2018 through 2025.

Previously the limit was none. The SALT deduction is one of the final tax details to be worked out in the House version of an up-to-3. Democrats reportedly are considering a plan to repeal the 2017 cap on the state and local tax SALT deduction for 2022 and 2023 only.

In 2021 the standard deduction would be 12550 and it would rise to 12950 in 2022. 54 rows Senate Majority Leader Chuck Schumer D-NY has expressed interest in repealing the SALT cap which was originally imposed as part of the Tax Cuts and Jobs Act TCJA in late 2017. As of the end of 2021 however it ends like this.

A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. Its a blow for Schumer who is up for reelection this year and pledged in 2020 to make repeal of the cap on SALT deductions a top priority if Democrats won control of. Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package.

If Congress decides to repeal the SALT deduction cap now the AMT and Pease limitation changes become more important. SALT Repeal Just Below 1 Million is Still Costly and Regressive Dec 11 2021 Taxes To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year. The change may be significant for filers who itemize deductions in high-tax states and currently can.

Nov 19 2021. Removing the marriage penalty and raising the SALT cap would also mostly benefit higher earners though after-tax incomes of filers in the 95 th to 99 th. Why repealing SALT could create a windfall for the wealthy While the maneuver may offer tax savings for some business owners it may not be the right move in all cases financial experts say.

That could appease the progressive Democrats without alienating most Republicans. However the bill stalled in December. The on-and-off cap The plan reportedly would repeal the SALT cap for 2022 and 2023 only.

House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before dropping it back to 10000 in 2031. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031. A possible compromise solution to reduce the havoc caused by the 2017 tax act would be to repeal the SALT tax for those earning less than 400000 per year.

Its a blow for Schumer who is up for reelection this year and pledged in 2020 to make repeal of the cap on SALT deductions a top priority. As of 2018 the maximum SALT deduction increased from 5000 to 10000. Prior to the Republican.

That means the limit of 24000 is important to have aware and also because. Manchin told CNN that the Build Back Better bill is dead That should spell the end for the SALT deduction a benefit for high earners in high-tax states. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Respectful Tax Day Which Some Also Know As Legalized Plunder Day Every April 15th Or So Is America S Official Deadline For Tax Day Income Tax National Debt

How To Build A Fun Family Time Capsule My Silly Squirts Time Capsule Family Fun Time Time Capsule Kids

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Dems Demanding Salt Tax Cuts Stand To Benefit

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Respectful Tax Day Which Some Also Know As Legalized Plunder Day Every April 15th Or So Is America S Official Deadline For Tax Day Income Tax National Debt

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Did You Know England Introduced A Tax On Hats In 1784 To Avoid The Tax Hat Makers Stopped Calling Their Creations Hats Character Fictional Characters Tax

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

3 Money Saving Tax Tips For Homeowners Utah Listing Pro Save Money Tax Tips Homeowner Tips Tax Season Real Estate Ta Tax Money Tax Season Saving Money

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Dems Somehow Pretend This Mostly Helps The Middle Class The Daily Postercommentsharecommentshare

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget